In Zimbabwe, the issue of currency is quite complex. Currently, we find two main currencies that are in circulation: on the one hand, the bonds which is the local currency; and on the other hand, the American USD. Having two currencies and a very ineffective monetary policy has caused the country to experience severe episodes of hyperinflation in recent years, which have led to a considerable rise in prices and, consequently, an increase in internal poverty of the country.

Next, we will try to briefly summarize the complexity of how the currency works and explain some transcendent details of the story. And finally, we will give some tips for travelers who want to go to Zimbabwe such as: how to pay in supermarkets, the issue of cash, where to change, etc…

Currency and history

One of the most important events in the history of this country was the year 2000 with the expropriation of land from white people by dictator Robert Mugabe (if you want to know more, you can read the history of the country here). This meant that Zimbabwe, which until then had been a country that exported many agricultural products, entered a spiral of endless poverty.

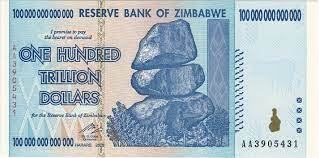

The country lost much of its agricultural production as these lands passed into the hands of government people who did not know how to cultivate and abandoned them; and therefore exports plummeted. In order to counteract this lack of revenue, the government responded by printing more banknotes in the market to pay off its debts and to encourage the economy. This, however, led to one of the most shocking hyperinflations in world economic history: 79.600.000.000% per month was the highest inflation, and the price doubled every 24 hours.

During the following years, the country was subjected to economic pressures where the local population was most affected. There were constant changes in monetary policy, prices were rising, and people were falling into the circle of poverty. November 2008 was the most severe peak of this long and agonizing inflation that raised prices and caused an instant increase in the poverty of much of the population. Then the Zimbabwean government put $100 trillion banknotes into circulation, which in return was only 4 USD. This serious crisis led to a catastrophic situation for many people in the country.

The country’s inefficient monetary policy during Robert Mugabe’s tenure brought many people to despair; caused the government to abandon the Zimbabwe dollar as its official currency in 2009 and caused foreign currencies to circulate in the country, such as the USD dollar or South African rand.

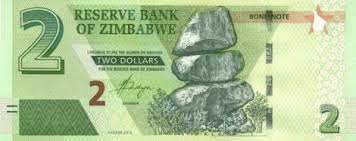

In 2015, the government began officially demonetizing the Zimbabwe dollar, reducing its value to zero in order to balance it with the US dollar, so that it could market the new currency, the bond. This caused people who still had Zimbabwe dollars to lose much of their value; and that many today rely more on the USD dollars than on their own currency. It is for this reason that many people nowadays prefer to have dollars rather than bonds, which is why in order to travel to Zimbabwe, the monetary issue is complex with the circulation of two different currencies circulating in the country.

If you travel to Zimbabwe, you will be able to remember this terrible economic and monetary stage of the country because there are many who sell the $100 trillion note as a souvenir. However, people are once again worried about the rising value of the local currency, which is rising in value, and the fear of further hyperinflation is very much present in many households in the country.

Monetary tips for travelers

– It is essential that you bring USD dollars cash to travel to Zimbabwe. This is the strongest currency in the country and the one you will use to get bonds (the other currency), pay in national parks and accommodation, pay for petrol and tolls, pay for the visa … Unlike Zambia, here the older 2006 dollars also serve.

– Bring small USD dollars notes. In many places there are no big notes changes, as most of the circulation of dollars is in small notes. At the tolls, for example, you have to pay 2 USD, and it was hard for us to get a change of 10 USD and 20 USD.

– To get bonds, which is the local currency and which you will use in local markets or to pay in supermarkets, you can do it in two different ways: you can go to a bank and exchange USD for bonds at the official exchange rate (you can also withdraw bonds from cashier, although some cards are not accepted); or you can change the USD on the street. Depending on which option you choose, you will have more or less bonds. If you go to the bank, for every USD you will be given less bonds than if you go to the street. For example, when we went there (October 2021), the bank gave you 80 bonds for every USD; while on the street you get 140 bonds for every USD. So we changed money to the street. To change in the street, you can ask someone if you want to get bonds and sometimes he will do it himself or tell you where to find those who exchange USD. You will find them sitting near banks, supermarkets… You will have to negotiate and ask various people, as at first they will give you a very low exchange rate.

– Payment by international credit and debit cards is not widespread. We travel with an international card called N26, and we could only use it to pay for some entrance fee of national parks like Matobo or Hwange; and major highlights of the country such as Great Zimbabwe. In other places like Mana Pools the card was not accepted. Therefore, please note that you will not be able to use your international credit card to make payments in the country.

– There is a local payment system called Ecocash. To use it, you’ll need a local mobile phone number that will be linked to the local SIM card (Econet) of your mobile phone you bought (worth about 80 bonds). This system consists of having the bonds in your phone account and you can pay in supermarkets and with people giving your mobile phone number. Once you have done this, you will receive a message which you will need to confirm in order to complete the purchase you are making. You will then receive a text message confirming the payment and the outstanding balance. To activate Ecocash on your phone, you will need to go to an Econet office and activate it. To charge the balance, you can do it with anyone as they will be able to send the money from your account to yours. That is, you can give USD to someone on the street and tell them to put the bonds with the exchange rate you agree on in your account. Think, however, of having the right money because as we have said the currency is very volatile and changes day by day, causing that money to lose value if the currency goes up. We used this system to shop at markets and in the supermarket; and so we did not have to exchange every day US dollars for bonds.

– Outside the supermarket, you will always find people who will offer to pay you with their Ecocash card or account. These are the so-called swippers. Think that if you pay in USD at the supermarket you will lose, as the bonds will be exchanged for the official exchange rate. So what they do is first negotiate a change with you, and then they offer you their local card, and you pay in bonds and then, once out, you give them the money in USD and cash. Calculate well what you buy in order to adjust as much as possible to the exchange rate. For example, if you agree that 1 USD will be 120 bonds; try to make the purchase a multiple of that number to give you the right dollars.

– When you leave the country, the bonds you have left will be obsolete. So calculate how many bonds you have left and try to spend them if you have them in your Ecocash account; or, if you have them in cash, you can save them for your collection of notes from different countries of the world if you want.

– Write an accounting book looking at all the USD notes you have, and what you want to spend. It went very well for us as we didn’t have a lot of dollars and that way we made sure we could see it all by doing many nights of wild camping.

0 Comments